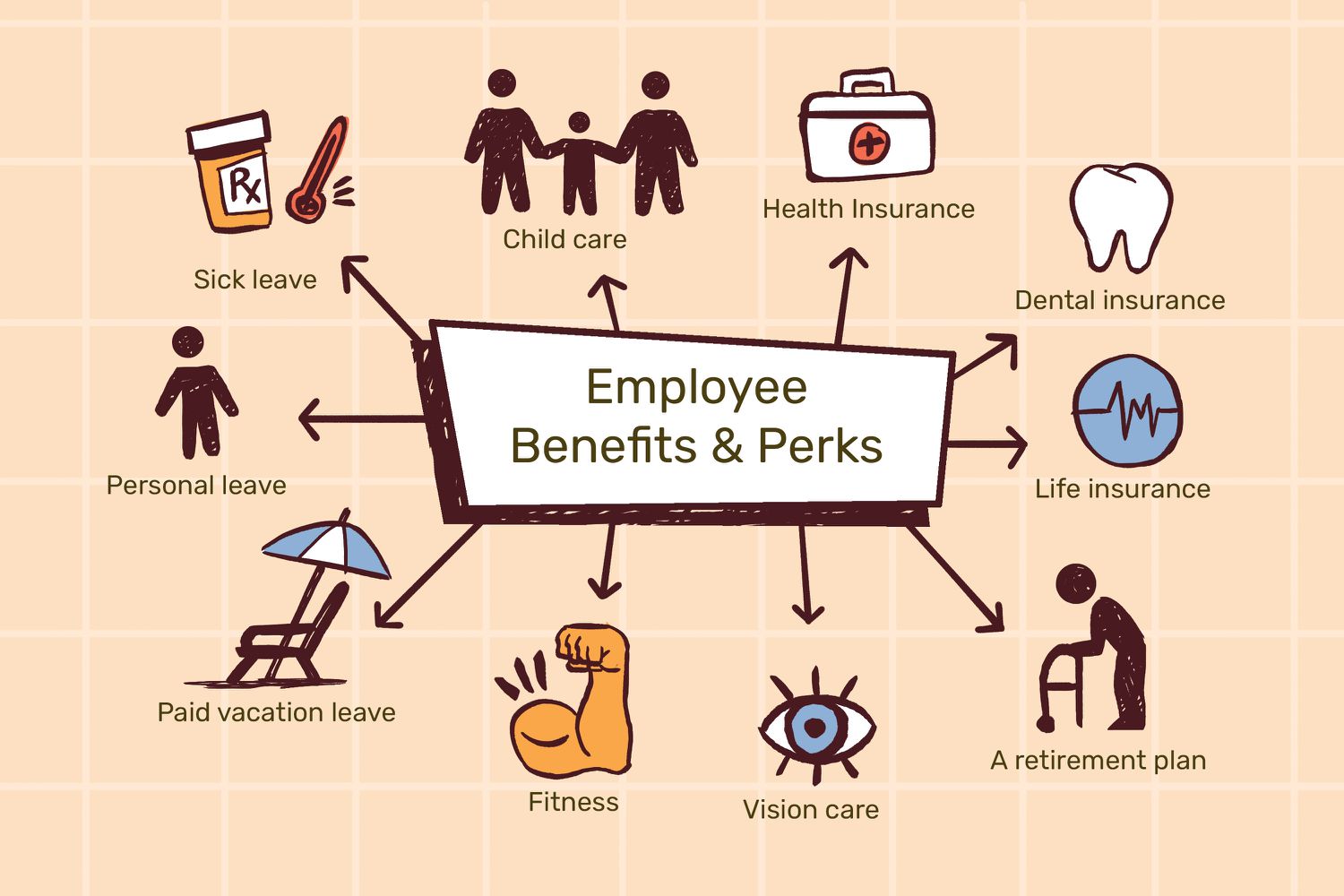

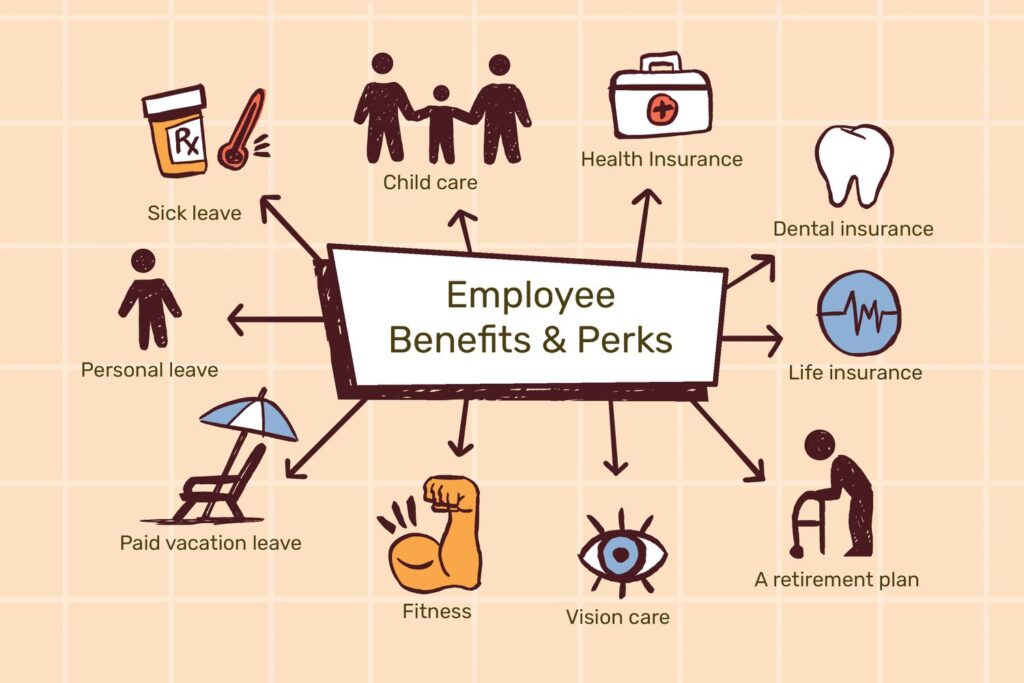

Employee benefits insurance is a crucial aspect of any comprehensive compensation package. It not only helps attract and retain top talent but also ensures the well-being and satisfaction of your workforce. In this guide, we’ll explore what employee benefits insurance entails, why it’s important, and how businesses can effectively implement it.

What is Employee Benefits Insurance?

Employee benefits insurance is a type of insurance policy that provides coverage for various benefits offered to employees by their employer. These benefits typically include health insurance, life insurance, disability insurance, retirement plans, and more. The goal of these benefits is to provide financial security and support to employees and their families in case of illness, injury, or other life events.

Types of Employee Benefits Insurance

- Health Insurance

- Medical Insurance: Covers the cost of medical care, including doctor visits, hospital stays, surgeries, and prescription drugs.

- Dental and Vision Insurance: Provides coverage for dental care, eye exams, glasses, and contact lenses.

- Life Insurance

- Group Life Insurance: Provides a lump-sum payment to beneficiaries in the event of an employee’s death.

- Accidental Death and Dismemberment (AD&D) Insurance: Offers additional benefits if the death or injury is due to an accident.

- Disability Insurance

- Short-Term Disability Insurance: Provides a portion of an employee’s income if they are temporarily unable to work due to illness or injury.

- Long-Term Disability Insurance: Covers employees who are unable to work for an extended period due to a serious illness or injury.

- Retirement Plans

- 401(k) Plans: Allows employees to save and invest a portion of their paycheck before taxes are taken out.

- Pension Plans: Provides employees with a fixed income upon retirement, based on their salary and years of service.

- Supplemental Insurance

- Critical Illness Insurance: Offers a lump-sum payment if an employee is diagnosed with a severe illness such as cancer or heart disease.

- Hospital Indemnity Insurance: Provides cash benefits to cover hospital-related expenses that may not be fully covered by health insurance.

Importance of Employee Benefits Insurance

- Attracting Top Talent

- Offering a robust employee benefits package is essential for attracting high-quality candidates. In a competitive job market, benefits like health insurance and retirement plans can be a deciding factor for potential employees.

- Employee Retention

- Employees are more likely to stay with a company that offers comprehensive benefits. These benefits provide peace of mind, knowing that they and their families are protected.

- Improved Employee Well-Being

- Access to health insurance and wellness programs leads to healthier employees, which can result in fewer sick days, increased productivity, and higher job satisfaction.

- Tax Advantages

- Employers can receive tax benefits for providing certain types of employee benefits, such as health insurance and retirement plans. This makes it financially advantageous for companies to offer these benefits.

Read More About: Free Proxies

How to Implement Employee Benefits Insurance

- Assess Employee Needs

- Start by understanding the specific needs and preferences of your workforce. Conduct surveys or focus groups to gather input on which benefits are most valued.

- Research and Compare Providers

- Look into different insurance providers and compare their offerings. Consider factors like coverage options, costs, and customer service when making your decision.

- Design a Custom Benefits Package

- Create a benefits package that aligns with your company’s budget and the needs of your employees. This may include a mix of mandatory benefits like health insurance and optional benefits like supplemental insurance.

- Communicate the Benefits Clearly

- Ensure that employees fully understand the benefits available to them. Provide clear and concise information through employee handbooks, meetings, or online portals.

- Regularly Review and Update the Plan

- Employee needs and company budgets can change over time. Regularly review your benefits package to ensure it remains competitive and meets the evolving needs of your workforce.

Common Challenges in Employee Benefits Insurance

- Rising Costs

- The cost of providing benefits, particularly health insurance, can increase significantly over time. Employers may need to adjust their offerings or seek more cost-effective solutions.

- Compliance with Regulations

- Employers must stay informed about changing laws and regulations related to employee benefits. Non-compliance can result in penalties and legal issues.

- Balancing Costs and Benefits

- Finding the right balance between offering competitive benefits and managing costs is a common challenge for employers. It’s essential to strike a balance that meets employee needs while being financially sustainable.

Conclusion

Employee benefits insurance plays a vital role in the overall compensation package and the well-being of employees. By offering a well-rounded benefits package, businesses can attract and retain top talent, enhance employee satisfaction, and ensure a healthier, more productive workforce. Regularly reviewing and updating your benefits package will help you stay competitive in today’s dynamic job market.